NEW: The peer-to-peer lending marketplace EstateGuru offers now a 0.5% bonus on all your investments made in the first 3 months. To receive it, you must register, comply with the terms and conditions and start investing. The bonus will be added to your investment account after the loan has been funded and transfered to the borrower.

EstateGuru is a leading Nordic online peer-to-peer lending platform established by property and FinTech professionals facilitating short- and mid-term property loans. The cross-border marketplace offers flexible terms for borrowers and premium interest to its investors. The loans of EUR 50 000- 3 000 000 facilitated through the EstateGuru platform are secured against property with a maximum LTV of 75%.

The mission of EstateGuru is to provide hassle free and flexible financing to property developers and entrepreneurs and property backed investment opportunities to its international investor base.

To date EstateGuru has been growing more than 300% a year and has established itself in Estonia, Latvia and Lithuania with more than 314 loans issued amounting to over €51 million. To date, EstateGuru has more than 11200 investors of different profile from 45 countries.

In the near future EstateGuru is launching the platform in Spain, Ireland and the UK.

How does it work?

A property owner, developer or entrepreneur proposes a business case for which they need funding. The professional team at EstateGuru will examine the application, and commission an independent valuation by a recognized third party.

If the independent review of the value of security, and the analysis of EstateGuru team’s due diligence, including of the borrower business plan and exit strategy is positive, the loan will be opened for investment. Within ten days of funding being successfully achieved through the platform, EstateGuru will set a charge on the property, releasing the funds to the borrower.

At EstateGuru Lenders earn interest on a monthly basis through the term of the loan, at rates that exceed most of the standard investment vehicles. Borrowers can quickly and efficiently raise competitively priced capital to bring their projects to life. Asset backed investing and borrowing has never been easier.

Who is eligible to invest?

You must be at least 18 years old and have a bank account any of the EEA member states or in Switzerland in order to lend through EstateGuru. EstateGuru also have to perform certain “know your customer” checks on you before you can start investing.

Using this referral link when you signup you will receive a 0.5% bonus of the total amount invested within the first three months.

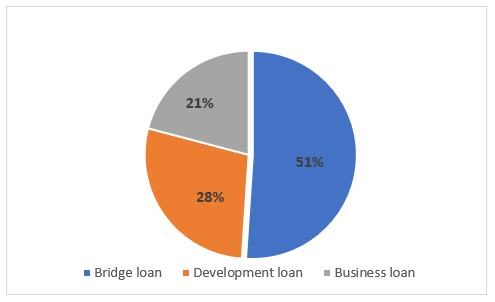

What type of projects can be founded on EstateGuru?

Real estate projects in Estonia, Latvia or Lithuania which are approved by our team can access funding through EstateGuru. However, there is no limitation on the type of projects that can be submitted for approval. As long as the project has a property element to it and the property is capable of being used as security for the debt, please feel free to submit it for approval.

Investing

EstateGuru makes it easy for investors to access a variety of real estate investments with a relatively small amount of capital. The minimum amount for investment is €50, which enables to create a diversified portfolio. All loans are secured with a mortgage.

The minimum investment amount is €50 and no fees apply to investors. All expenses are covered by the borrower.

Both manual and auto-investment are availabile. Auto Invest is a feature that allows you to invest your funds automatically in all loans available for investing on the EstateGuru platform.

The main keywords for the Auto Invest feature are comfort, speed and automatization.

• Auto Invest ensures you will not miss an investment opportunity due to high demand and the investment will be placed based on your chosen criteria automatically, without you having to stress about it;

• Auto Invest enables you to build a diversified portfolio, in which all the projects are chosen by a professional team who stands for the success of your investments;

• Auto Invest enables you to reinvest your income at the earliest opportunity. This way you start earning interest on committed funds as soon as possible.

EstateGuru in numbers

- Money lent: 52 579 833 EUR

- Total value of propertie funded: 101 878 932 EUR

- Number of funded loans: 324

- Number of repaid loans: 127

- Number of loans in default: 2

- Recovered loans: 1

- Registered investors from 45 countries: 11 638

- Historical annual return of repaid loans since 2014: 12.44%