Iuvo is a p2p platform based in Tallinn, Estonia, which allows its users to invest in loans, granted from Originators (nonbank financial institutions – Easy Credit, Viva Credit, iCredit, BBG , Fast Finance). The Investors can make a motivational profit, and the Originators benefit by the extra funds to help them expand their business.

After the loan is granted by the Originator, it is uploaded on iuvo, where the Investors can see it and choose to invest in it. The Investor receives their profit from the principal with interest after the installment is payed off.

In case the Borrower stops paying the loan, the buy-back guarantee activates immediately and the Investor gets their investment back.

Iuvo Group OŰ is a company, licensed by the Financial Supervision Commission of Estonia, according to Decision № 4.1-1/133 of the Management board of the Commission. Iuvo Group OŰ is regulated credit intermediary from the Estonian Financial Commission.

IUVO strives to provide investors with a world-class user experience through its diversified credit portfolio of trusted originators, as well as superior platform simplicity.

Iuvo is a Latin word that means “to help”, “to save”.

Who can invest at Iuvo?

Iuvo is a platform that is open to individuals and companies.

The individuals must be at least 18 years old, and they need to have a valid bank account within the European Union or third countries that are currently considered as having equivalent AML/CFT systems to the EU.

For the companies it is required to have a valid bank account within the European Union or third countries that are currently considered as having equivalent AML/CFT systems to the EU. Their data and funds origin, according to the Anti-money laundering and Financial Terrorism policies and regulations mentioned above. (AML/CFT).

How can funds be deposited to the investor account at Iuvo?

You can make a deposit to your iuvo account by some of the following methods:

– a bank transfer from your bank account with a payment order or by using your online banking;

– at the cash register of a bank;

– a transfer, made by using electronic money services such as: Paysera, ePay, Transferwise, Currency Cloud, Revolut, etc.

Please, bare in mind that there is no minimum or maximum amount of money you can deposit.

You can find our bank details on you account–>”Deposit“. Please, follow the instructions.

You can invest in three different currencies at the same time: BGN, EUR, and RON. It is necessary to make a bank transfer to the corresponding account.

Please, bare in mind that right now Iuvo do not offer currency conversion.

You have two investing options in iuvo – manual and automatic.

The manual investing includes: credit details review; choosing which particular credit to invest in, adding to your Cart and confirming the investments.

The Auto-Investing option includes: creating a portfolio, where you can apply certain filters. After you start Auto-Investing, the software invests in loans that fit your criteria.

The minimum amount you can invest in the Primary Market is as follows: 10 BGN, 10 EUR, 25 RON. There is no minimum amount for investing on the Secondary Market.

Iuvo fees

The platform does not have any charges for investing, making a deposit, or withdrawal. The only charge that may apply is when you sell a loan on the Secondary Market – 1% of the amount.

Please, bare in mind that this does not include any charges that your bank may apply.

The credit rate scores

One of the methods by which the originators control the risk, is using a credit rate score system. This is a procedure of classifying every credit in different categories, based on the default probability (the probability the borrower to stop paying off their loan).

All loans in iuvo have a score rate. This is needed so the credits from different originators can be compared.

The credit score rates in iuvo are:

A 0 – 4% default probability

B 4 – 10% default probability

C 10 – 18% default probability

D 18 – 25% default probability

E 25 – 35% default probability

HR above 35% default probability

All loans listed on the platform have the so called buy-back guarantee. This means that the Originator is obligated to buy back the credit from the investor at its nominal value in case the borrower stops paying off their loan. The Originator will restore the investment back to your iuvo account.

The buy-back guarantee activates on the 61-st day, counted from the date of the first unpaid installment.

Withdrawals

In order to request a withdrawal, you need to verify your identity and address. You can do that by applying the following documents:

*for Individuals

– ID Card – both sides of your ID Card or Passport;

– current utility bill, addressed to you or

– official document from the Authorities or

– other documents, confirming your address;

*for Companies

– ID Card of the account’s owner – both sides or Passport;

– A current status certificate or Commercial register extract;

– A document from the Authorities that is addressed to the company (confirming the address);

You can attach your documents through the platform in the “Documents” section.

Regarding the Anti-money laundering policy of the European Union, you need to verify your address in order to withdraw money from your iuvo account.

You can request a withdrawal at any given time from the “Withdraw” button. You can only withdraw the funds that are not invested at the moment.

You can cancel your withdrawal request from “Withdraw” button -> “Withdraw History.

All withdrawals from the platform are processed within two working days.

*Please, bare in mind that the bank transfer can take more time, depending on the bank’s conditions.

You can only transfer funds to a bank account that you have deposited from. If you have transfered money from more than one bank account, you will have the opportunity to choose which one to transfer the funds to.

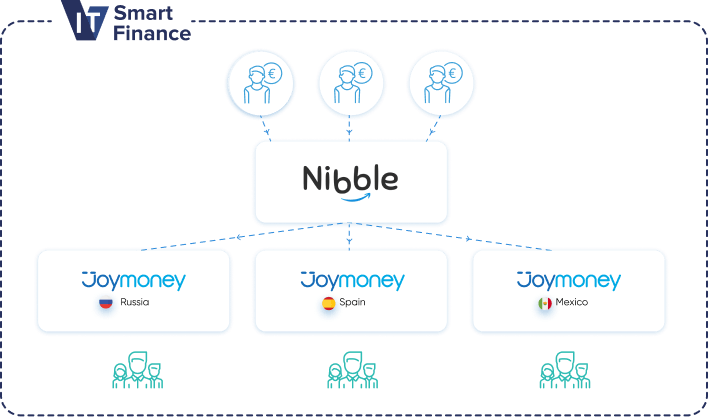

Russia

Russia Spain

Spain Mexico 2020

Mexico 2020