Every time we think about the idea of making investments, the first thing that automatically comes to mind is the notion of risks.

This way of thinking is typical for the field of investments and is much less present in our normal, everyday life.

Or not…?

How present is the concept of “risk” in our lives?

Obviously, certain risks normally exist for us no matter what we do, only we don’t think about them all the time and we don’t worry too much.

Because they are quite small, and most of the time they are even EXTREMELY small.

For example, how many times do you happen to climb the stairs and fear that you might stumble and break a leg? Or how many times do you walk down the street with fear of having a serious accident?

Probably quite rare…

And yet, such accidents happen, because we hear about them many times and we even see them on TV.

However, they are very rare (thankfully!), So it would be abnormal to live our lives in constant fear of them, always thinking about these risks and everything that could happen.

In terms of investments, however, the way of thinking is exactly the REVERSE!

Every time we are interested in a certain investment, we must analyze very carefully the situations in which things could go exactly the opposite of how we hope.

What would happen in those cases, how we would react to an adverse scenario, how much we could lose – all this must be part of our plan from the beginning.

For the simple reason that sometimes these investment risks do occur, no matter how carefully and inspiringly our initial plan was made.

Therefore, the question we need to ask ourselves is not “IF” but, rather, “WHEN” the risks associated with each investment will occur.

It is very important to find out the answer to the question “HOW MUCH” can we lose if those risks occur. Because depending on this answer we know how to plan and manage our investment correctly from the beginning.

In any investment, the main concern related to risks is that, in case they occur and we have losses, they should be as limited as possible.

Because all investors, absolutely ALL, face these investment risks and therefore sometimes incur losses.

Even the famous Warren Buffett, probably the biggest investor of all time, constantly in the top of the richest people in the world, reported a significant loss a few years ago as a result of his investment in Tesco.

What is interesting is that, although in absolute terms this loss seems huge (being several hundred million dollars), in fact it represents only about 0.2% of the net value of the company run by Buffett (Berkshire Hathaway).

In fact, over the last 50 years, Berkshire Hathaway has once lost 2%, with the rest being less than 1% of its net worth. These impressive results confirm that the winning strategy is to keep the risks to a low level, and therefore the potential losses.

How can you effectively protect yourself from risk?

Self-knowledge and study are the most important elements when it comes to investing.

If you understand how you react to risks and potential losses, it will be much easier for you to build a portfolio that fits your risk profile and helps you achieve good long-term results.

Here are 4 things you should always think about BEFORE making a certain investment, so as not to expose yourself to too much risk:

1. How much can you afford to lose?

How much money do you have available for these investments? And, most importantly, how many of them could you lose without significantly affecting your portfolio (or even your standard of living)?

In addition to answering these questions, you need to think about whether you are comfortable with the fact that you will make those amounts unavailable for a certain period of time, specific to each investment.

2. What is your time frame?

The time frame for which you intend to invest is directly related to those risks that you are willing to accept.

The longer you invest for the longer term, the more chances you have of recovering from any declines, so you could take, at least theoretically, higher risks.

On the other hand, as you get closer to your goal (eg financial independence), you need to prepare your portfolio properly so that you decrease the total level of risk you take.

3. How well do you know the investment you want to make?

The main risk of an investment is the investor himself. Or, as Warren Buffett says, “Risk exists when you don’t know what you’re doing.”

So, before you embark on a particular investment, get seriously informed and try to really understand how that investment works.

What are the main risks? What might not be going well? What are the positive scenarios and what are the negative ones?

And, most importantly, what will YOU do in each of these scenarios?

Once you find the answers to these questions, it will be much easier for you to make a concrete plan, which you can implement when the situation demands it.

4. How do you deal with these risks emotionally?

Your emotional ability to cope with change, unforeseen and potentially dangerous situations is very important.

If riskier investments stress you out and affect your daily life, you should probably turn to lower risk instruments.

Even if it is said that high profits are usually brought by investments with higher risks, you should know that there are enough profitable options to invest with medium or even low risks, so that, in the long run, you do not end up ruining your life and the health.

IN CONCLUSION, you can reduce the risks of your investments by investing:

– in a diversified portfolio, with investments that you understand

– which is adapted to your risk profile

– long-term and very long-term

– investing regularly, amounts with which you are comfortable.

This way you will be able to build an investment plan to help you get good profits, in conditions of limited risks.

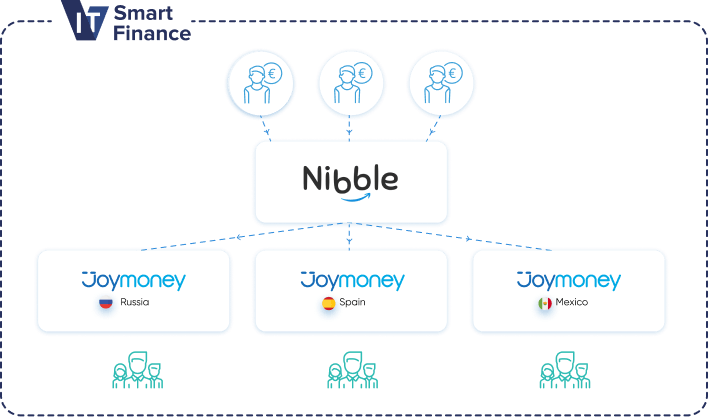

Russia

Russia Spain

Spain Mexico 2020

Mexico 2020