How do we protect ourselves from inflation?

The signs of inflation are becoming more pronounced and have begun to be seen in the wider world. Although the Federal Reserve and the Central Banks assure us that this rise in inflation is temporary, things are not so sure.

It would not be the first time that the authorities of any kind assure us that not much will happen and yet, after these assurances, exactly what they assured us will not happen happened.

It seems that we are in shortage of raw materials and inputs of all kinds: industrial metals, plastics, wood, foodstuffs, semiconductors and many more… and this contributes greatly to rising inflation.

Not all of these increases have been passed on 100% to final consumers, but they will be passed on in the near future. In other words, products of all kinds will continue to become more expensive in the near future.

The combination of low production during a pandemic + money injected into the system + billions of people escaping lockdown and restrictions and preparing to consume and travel, all this forms a super favorable cocktail for inflation, at least in the short and maybe medium term.

Who loses because of inflation?

- Those who save – Cash or savings accounts with zero and some interest + those kept in long-term deposits will be affected. They are already devalued compared to a few months ago.

- Consumers – Because most of the products and services we consume become more expensive.

- The heavily indebted (who have variable interest rates) – Because variable interest rates will most likely increase.

- Part of the investors in shares – Inflation creates some disturbance on the stock market, especially for those who hold growth-type shares who live on debt and do not produce enough cash flow and profit. Inflation creates the preconditions for rising interest rates, and this could lead to a decrease in the quotations of many companies, especially those that:

- are indebted

- do not produce enough profit and

- are heavily dependent on the price of raw materials and that they cannot afford to easily transmit those costs to consumers.

- Fixed income bondholders – Fixed income instruments depreciate when inflation rises.

Who wins due to inflation?

- Indebted States – Given that most government securities are issued at fixed interest rates, below inflation and in the long term, states have the opportunity to reduce their debt burden through inflation. Well, what does inflation mean? Devaluation of money. And who benefits from the devaluation of money? Those who borrowed money with fixed interest and, more precisely, who are the biggest borrowers who benefit from low fixed interest rates? They are the issuers of government securities, ie the States.

- Manufacturers – Inflation means the appreciation (in monetary terms) of real values in the economy: goods and services that meet real needs. They are not necessarily valued, but only valued in monetary terms – more money on the market, the same amount of goods and services, resulting in more money for the same amount of goods and services. Of course, producers can lose if they do not pass on to consumers the high costs of raw materials. In the end, however, most producers will raise their prices if the market allows it.

- Goods and companies producing goods (energy goods, industrial metals, agricultural raw materials)

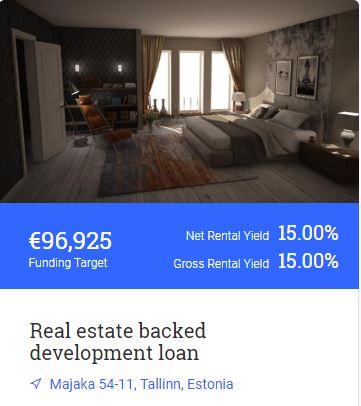

- Real estate owners – real estate is traditionally a good hedge against inflation. All raw material prices have risen – well buildings are made of raw materials and now it costs much more to build a block of flats or a house than last year. If you already own that house / apartment, then the value of your property has just increased due to the increase in raw material prices.

- Shareholders in companies producing solid cash flow will most likely benefit from inflation. This would include companies that have a low degree of indebtedness and a high profit margin, this includes companies that can easily make products more expensive (they don’t have much competition): this includes banks and other solid businesses that are cash flow machines.

What can we do concretely to protect ourselves from inflation?

- Pay debts with variable interest rates – If we have money lying in deposits, then it would be an obvious but important step. Even if we can’t pay our loans in full, it’s good to pay in part. With inflation, interest rates increase and consequently your bank rates will increase.

- Convert variable interest loans into fixed interest loans – If we cannot pay our loans, we can try to renegotiate / refinance them to convert them into fixed interest loans. If there are quite a few options to obtain long-term fixed interest loans, we can look for solutions that cover at least one period of the loan, if not the whole period.

- Beware of bonds and government securities – If we have bonds or government securities with fixed interest, along with inflation, they will decrease in value, and the interest paid by them may become real negative.

- Consume less – When the prices of goods and services rise, ie we have inflation, it is a good time to optimize and streamline consumption. If in the periods of low inflation we allowed ourselves to be more “broad-handed”, in the periods of inflation we can no longer afford to buy much and for no reason, because it costs us more.

- Make long-term contracts – We block any recurring cost through long-term subscriptions. Here we are talking about costs that we have anyway, not new costs.

How do we profit from inflation?

- We become producers

When you have a fixed income (salary), there are little chances to counteract inflation. Any increase in revenue will come with a significant delay over inflation. If you get your income from freelancing or a business, you have the freedom to raise prices and take advantage of inflation.Inflation essentially means that there is too much money on the market compared to the amount of goods and services available. When you position yourself on the side of the producer, you are actually positioning yourself on the winning side of the barricade. - Invest in shares of companies that profit from inflation

In general, stocks are positively influenced by inflation, given that most listed companies can raise prices with the devaluation of money.However, inflation can affect the value of companies such as those with fixed incomes (subscription-based incomes such as telecom or utility companies) or those with excessive indebtedness.The companies that could benefit from inflation are either those that benefit directly from rising interest rates (banks), or those that have the flexibility to raise prices: energy, food, consumer goods, etc. - Real estate

Real estate in general tends to keep up or even exceed inflation. In addition, the owner of real estate for rent has the opportunity to protect himself from inflation by increasing the rent. - Commodities and precious metals

Gold is traditionally an asset that protects us against inflation (long-term and very long-term), tending to appreciate in times of inflation. However, we must know that in the short and medium term, gold is not required to follow inflation (but only in the long term).You can invest directly in physical gold or in financial instruments that have gold as their underlying asset.Commodities are generally appreciated during inflationary periods. They are very sensitive to inflation. You can most easily invest in commodities either by buying a commodity ETF (synthetic replication) or by buying shares of commodity producers. - Invest in stock indices

Moderate inflation will favor stocks in general. Too high inflation can affect them in the short term (the reasons are multiple – many companies cannot instantly pass on to consumers rising raw material costs + indebted companies are affected by rising interest rates + higher interest rates mean lower stock valuations).In the medium and long term, stocks are generally a very good protection against inflation, having, historically (the US market in the last 100 years), a significantly positive net inflation return of approx. 7% (7% + inflation).

Conclusion

Finally, we must remember that all the above actions and instruments can protect us from inflation theoretically, but the economy is a living organism and the appreciation or depreciation of various assets are influenced by many other factors besides inflation: economic growth, demand, psychological, demographic or social factors etc.

A prudent approach, a diversified allocation of assets and a constant focus on value creation will often position us as winners, regardless of market conditions.

An educated mind that constantly learns and constantly tests will have the ability to adapt to any market conditions and will thrive in the long run.