How to Choose the ETFs That Fit You

How to Choose the ETFs That Fit You

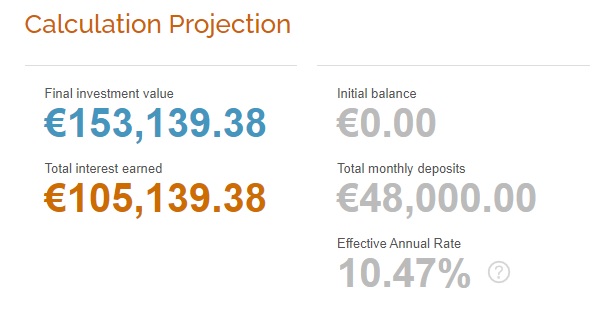

Starting to invest doesn’t have to be complicated—especially when execution costs aren’t fighting you. With trading fees as low as 0.14% + €3 on European markets and zero custody fees, the frictions you feel most are no longer at the broker. They are upstream—in the way you set objectives, select exposures, and control risk. This article lays out a complete, analyst-grade framework: from purpose and horizon to replication, TER vs. tracking difference, liquidity, taxes, hedging, and a disciplined implementation plan.

1) Purpose, Horizon, Constraints: the Investment Triangle

Every ETF choice sits inside a triangle of purpose (what you’re solving), horizon (how long capital stays), and constraints (risk tolerance, taxes, liquidity needs). Reverse the sequence and you get noise. Lead with the triangle and product selection gets easier.

- Purpose: Are you building long-horizon wealth (retirement), a medium-horizon goal (home, education), or a buffer (emergency fund)? Each maps to a different volatility budget.

- Horizon: Short horizons amplify mark-to-market risk. Long horizons make drawdowns survivable—if the allocation is appropriate.

- Constraints: Tax regime, currency of liabilities, need for distributions, ethical screens, maximum drawdown comfort.

Ray Dalio frames diversification as the “Holy Grail”: reduce expected risk more than expected return. Warren Buffett counters that diversification can be protection against ignorance. Both are true—at different stages. Early on, default to breadth. With skill and proof, earn the right to concentrate.

2) When ETFs Are the Right Tool—And When They Aren’t

ETFs are access technology: low cost, transparent, tradable. They’re superb for equity beta, broad bond exposure, and systematic tilts. But they’re not always optimal.

- Emergency funds & near-term cash: Prefer direct purchases of very short-dated government bills for precise maturity and rate control. Bond ETFs, by design, roll maturities and carry small duration risk.

- Idiosyncratic convictions: If your edge is in a single issuer or niche, an ETF may dilute the thesis—use with care.

Outside of these cases, ETFs remain the default for most long-run portfolios.

3) The Core Allocation: Theory That Still Works

Seven decades after Markowitz and Sharpe, the core idea persists: pair growth assets with stabilizers. In ETF-land, that looks like one or two broad equity funds, one or two bond funds, and optional sleeves for real assets.

Classic 60/40 (modernized)

60% global equities (developed + optional EM), 40% investment-grade bonds (global aggregate with attention to duration).

All-Weather–style balance

~30% equities, 40–45% government bonds split across durations, 10–15% inflation-linked, 5–10% real assets (commodities/gold via UCITS/ETC).

Choose a baseline, automate contributions, and rebalance annually. Complexity is optional; discipline is not.

4) What Exactly Are You Buying? Index, Structure, Replication

4.1 Index definition

MSCI World (developed-only) is not FTSE All-World (developed + emerging). Sector tilts differ across providers. Read the methodology: country eligibility, free-float adjustments, small-cap inclusion, reconstitution rules.

4.2 UCITS and domicile

For European investors, UCITS funds domiciled in Ireland or Luxembourg are the standard. Domicile affects tax treaties and dividend withholding leakage (especially on U.S. equity exposure).

4.3 Physical vs. synthetic replication

- Physical: holds the underlying securities; simple, transparent. May engage in securities lending—check the revenue split and collateral policies.

- Synthetic: uses swaps to track the index; can improve tracking for hard-to-access markets but adds counterparty complexity. UCITS limits mitigate risks; still, understand the structure.

4.4 Full replication vs. sampling

Full replication owns all constituents—best for liquid, concentrated indices. Sampling owns a representative basket—common in very broad or less liquid universes; reduces costs but can increase tracking error in stressed liquidity.

4.5 Distributing vs. accumulating

Distributing share classes pay out dividends; accumulating reinvest them. Match to cash-flow needs and your tax context. Over long horizons, automatic reinvestment simplifies compounding.

5) The Cost Reality: TER vs. Tracking Difference

TER (Total Expense Ratio) is the sticker price; tracking difference (index return minus fund return) is the paid price. A 0.07% TER fund with poor sampling or wide spreads can cost more than a 0.12% TER fund with tight tracking and deep liquidity. Compare like-for-like over the same period and currency.

- Large, liquid universes (e.g., S&P 500 UCITS) often show TERs near 0.03%.

- Smaller or frontier markets can run to 0.50–0.70%.

- Spreads, securities lending revenue, and tax leakage all feed into tracking difference.

Compounded over decades, a few basis points matter. You control this lever—use it.

6) Liquidity, Spreads, and Capacity

ETF liquidity has two layers: secondary (exchange volume, bid–ask) and primary (AP creation/redemption in the underlying). AUM and 3-month ADV are good first filters; then inspect the bid–ask spread and intraday premium/discount behavior.

- Prefer funds with stable AP support and consistent spreads in volatile sessions.

- Check multiple listings (Xetra, Euronext, LSE) if your broker routes across venues.

- For very large orders, consider risk or NAV-based trades via your broker.

7) Currency, Hedging, and the Liability Side

Decide at the portfolio level how much FX risk you accept. Many long-term investors keep equity exposure unhedged (growth offsets FX noise) and hedge parts of the bond book to align with spending currency. Hedged share classes add a small ongoing cost; they reduce FX volatility but do not change expected returns.

8) Putting It All Together: Model Line-ups (Illustrative)

Global Core (accumulating)

- 70% Global Equity UCITS (World or All-World)

- 20% Global Aggregate Bond UCITS (EUR-hedged share class)

- 5% Gold ETC (UCITS-friendly)

- 5% Broad Commodities UCITS

Rationale: equity growth engine; bonds stabilize and match euro liabilities; small real-asset sleeve for regime hedging.

Quality Tilt (long horizon)

- 50% Global Equity UCITS

- 15% Quality factor UCITS (global)

- 10% Dividend growth UCITS

- 20% Global Aggregate Bond UCITS

- 5% Gold ETC

Rationale: systematic tilts toward resilient earnings and income; still anchored by a broad core.

All-Weather Bias (defensive)

- 30% Global Equity UCITS

- 25% Long-duration Gov Bond UCITS

- 15% Intermediate Gov Bond UCITS

- 15% Inflation-Linked Bond UCITS

- 7.5% Gold ETC · 7.5% Broad Commodities UCITS

Rationale: regime diversification: growth, disinflation, inflation, and commodity shocks.

Implementation discipline: automate monthly contributions, rebalance annually (or when weights drift by ±20% relative), document changes in an Investment Policy Statement.

9) Due Diligence Workflow (Repeatable)

- Define exposure (index, region, cap range, factor).

- Screen UCITS ETFs (domicile, provider, AUM, ADV, spread).

- Compare costs (TER, 3–5y tracking difference, lending policy).

- Assess structure (physical vs synthetic; full vs sampling; distributing vs accumulating).

- Tax (withholding leakage, your personal regime, ISA/PEA/third-pillar constraints where relevant).

- Operational (listings you can access, settlement, broker fees—e.g., 0.14% + €3; zero custody helps).

- Write the rationale (1 paragraph). If you can’t explain it, don’t own it.

10) Advanced Topics: Factors, Bonds, and Real Assets

Equity factors

Quality (profitability, low leverage) and dividend growth pair well with a global core. Small-cap raises cyclicality; size positions modestly.

Fixed income

Duration is your macro lever. Keep the bond sleeve simple (aggregate + govies), then add inflation-linked if your liabilities are CPI-sensitive.

Gold & commodities

Use UCITS-compliant ETC/ETFs. Keep sizing measured (5–10%)—they hedge regimes, not day-to-day moves.

11) Behavior: Where Portfolios Live or Die

The best ETF line-up fails without behavioral guardrails. Write—and sign—three rules:

- Loss rule: “If the equity sleeve draws down 25%, I rebalance to target, not de-risk.”

- Gain rule: “If a tilt doubles, I trim back to policy weights.”

- Change rule: “I change the policy portfolio only after a 30-day cooling period and a written memo.”

Larry Fink often notes: ETFs democratize access. The edge is not cleverness; it’s consistency at low cost.

12) A Short, Real-World Contrast

Two globally popular UCITS ETFs—one tracking MSCI World (developed-only), one tracking FTSE All-World (developed + emerging)—delivered different 5-year EUR outcomes (~low three digits vs. high nineties %). Neither is “better” in isolation; the index design, EM inclusion, and sector weights explain the gap. The “right” choice is the one that fits your purpose, horizon, and constraints.

Bottom Line: A Framework That Scales

- Start with purpose, horizon, constraints.

- Pick a core allocation and keep it boring.

- Understand index, structure, replication.

- Optimize real costs: TER and tracking difference.

- Mind liquidity, taxes, and FX hedging.

- Add tilts deliberately; size them modestly.

- Automate contributions; rebalance annually; document changes.

Do these things at low cost—and let time and compounding do the heavy lifting.