Most people get stuck until they reach the first 1, followed by a few zeros of earned /saved/invested money, and they stay in the “start” area for the rest of their lives, taking it over and over again from the beginning.

This is why most people do not become financially independent and do not truly achieve financial prosperity.

The first 1000 EUR invoiced from the new business;

The first 10,000 EUR invested on the stock exchange;

The first EUR 100,000 in the personal portfolio;

The first studio for rent;

First salary / bonus etc. of EUR 3000 (the example is relevant, even if it does not start with 1)

The effort to reach the first 1, followed by a few zeros, is enormous and many give up along the way. What they don’t know is that after you hit a 1 followed by a few zeros (2,3,4 etc.), the rest of the zeros are much easier to reach.

After 10 years of struggling to reach a portfolio of 100,000 EUR, most likely up to 200,000 EUR could take you much less, up to 300,000 EUR less and so on.

The same applies to investments. You can constantly invest 200 EUR per month, without seeing a big difference in the portfolio, until, at a certain moment, the compound interest intervenes and your portfolio grows rapidly.

The graphic result is more than clear:

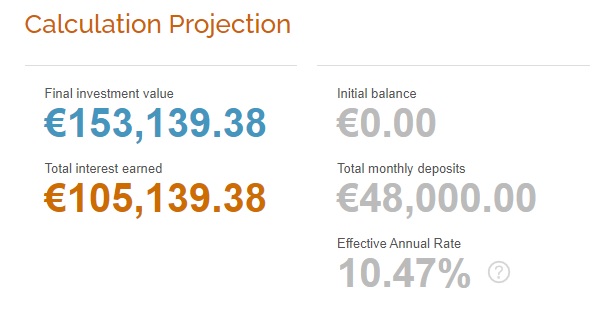

200 EUR invested monthly for 20 years at 10% interest

The result is:

Result after 20 years

The graph “speaks” for itself:

Balance after 20 years

So don’t get lost on the road, but continue at maximum acceleration, until you reach that goal of 1 followed by a few zeros.

After that point, things will become easier, automated, routine.