LendSecured real estate crowdlending platform overview

LendSecured is a real estate crowdlending platform, based in Riga, providing only real estate backed business investment opportunities.

LendSecured was founded by two entrepreneurs, who have built a successful secured lending business in Latvia, specializing in real estate backed lending to businesses. The return they have brought to stakeholders of their business was on average 10% annually. The emergence of technological solutions has inspired the founders to build an investment platform and offer the same lucrative investment opportunities for a wider public.

LendSecured platform was created in 2017, as a private tool for investors, enabling them to monitor their loan portfolios. During these years, the platform has been developing its core business (mortgage lending), gathering experience and building loan portfolios.

Since 2017 the platform was accessible exclusively for high net worth investors, but now they are opening it for the public.

The core pillar and philosophy for LendSecured is to minimize the risks. LendSecured feels responsible for their clients and believes that if investors have trusted them with their funds, then it is their duty to offer the safest possible investment opportunities. In order to minize the risks, LendSecured publish investment projects with low LTV (Loan to Value ratio). The lower the ratio, the lower the risk.

LendSecured benefits from debt collection license (Loan MGMT Ltd.). Besides that, LendSecured is the member of European Crowdfunding Network since 2020.

In order to ensure the security of the clients funds LendSecured has partnered with the prominent payment solution provider Lemonway, which is a Fintech founded in 2007 and regulated by Banque de France. Lemonway is obliged by the regulator to hold all money received on behalf of its clients on a separate account, which is held with BNP Paribas (the largest bank of France by value of assets), thus investors of LendSecured can have a peace of mind, as their funds are held safely on a segregated bank account monitored by French Central Bank. This fact totally excludes the chance of fraud, which recently has occured on other platforms in P2P sector.

Moreover, Lemonway is doing all compliance checks, KYC & AML procedures of all funds credited to LendSecured’s account. This helps LendSecured to speed up the investment process and be assured that they comply with all the latest regulations set up by the EU.

If you invest for the first time at LendSecured don’t forget that you can get a 0.5% cashback bonus for the investment amount.

Who can invest at LendSecured?

Anyone who is above 18 years old can become a client. To register, you need to submit a copy of your passport or ID document and wait until our team completes your identification process. Once all KYC and AML procedures are done, you can invest!

Every investor must have an opened bank account in the Single Euro Payments Area (SEPA).

Investment deals on LendSecured platform

Lendsecured accepts projects with Loan-to-Value (LTV) of 50% on average, maximum reaching 70%. The lower the LTV, the smaller the risk to an investor. The LTV of 50% means that the value of a real estate is as twice as high as the loan amount. This means that in a situation, where the loan ought to be recovered from the sale of the real estate, the value of the real estate will be more than enough to cover the amount lent.

All mortgages can be monitored online on the Land Register of Republic of Latvia: www.zemesgramata.lv.

There are three repayment types that are featured on LendSecured:

- annuity– where interest is paid monthly together with the loan principal amount spread over the life of the loan.

- bullet repayment type, the most common type, where borrower makes interest payments monthly, but principal repayment is made in one full payment before the end of the loan maturity.

- full bullet where there is no interest, nor principal payments during the life of the loan. The sum consisted of entire interest and principal is repaid at the end of the maturity date.

The minimum investment amount on the LendSecured platform is 50 EUR and the average loan term is 12-18 months.

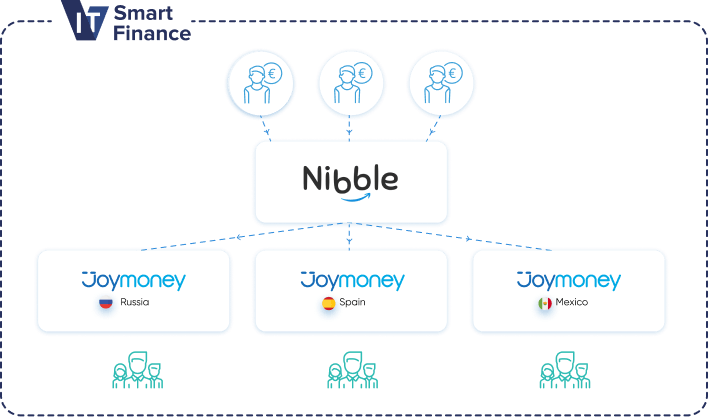

Russia

Russia Spain

Spain Mexico 2020

Mexico 2020